Are fireworks banned where you live? Check your insurance policy before you light them

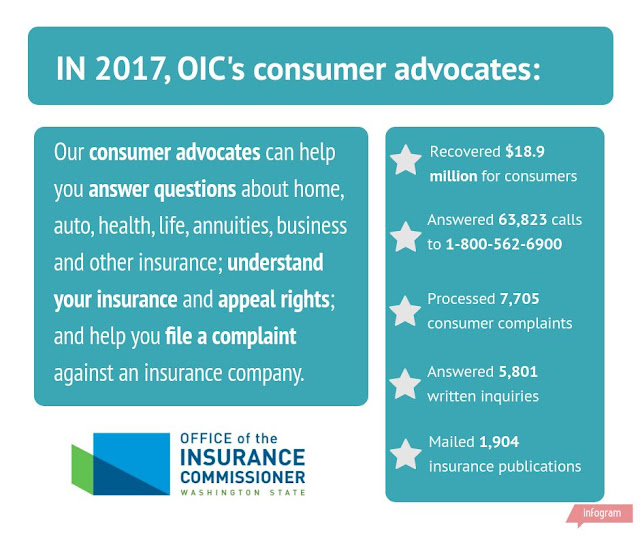

Before you celebrate the Fourth of July holiday, here are a few things to consider: Some cities in Washington state have banned fireworks. If you live in one of those cities and cause a fire with fireworks, your homeowner or renter policy may not cover the loss. Talk to your agent or broker, or read your policy to be sure. Washington State Patrol has a list of cities that have banned fireworks for personal use, and a list of public fireworks displays. More fires are reported on the Fourth of July than any other day, according to the National Fire Protection Association. On average, 250 people go to the emergency room every day with fireworks-related injuries in the month around July 4, according to the U.S. Consumer Product Safety Commission (CPSC). The CPSC reports that in 2016, 11,000 people were treated for fireworks-related injuries. Consumers can get help with their insurance or ask insurance-related questions by calling our consumer advocates at 1-800-562-6900